Punjab Cabinet Meeting: No Question Of SYL As Punjab Has No Spare Water To Share With Other States

Chandigarh News: The Punjab Cabinet led by Chief Minister Bhagwant Singh Mann on Thursday gave its approval to appoint leading Advocate Gurminder Singh as new Advocate General of Punjab.

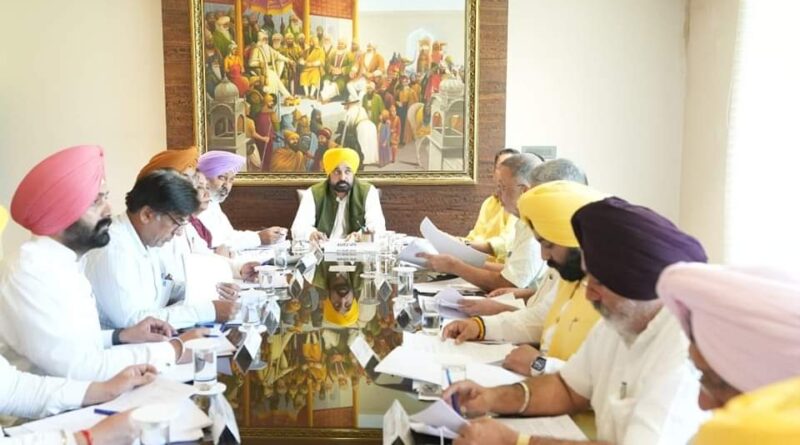

A decision to this effect was taken by the Cabinet in its meeting held under the chairmanship of the Chief Minister at his residence today morning.

The Cabinet accepted the resignation of incumbent Advocate General Vinod Ghai, who had tendered his resignation due to personal reasons. Meanwhile, the name of eminent lawyer Gurminder Singh was cleared for the top legal post of the state.

SAYS NO QUESTION OF SYL AS PUNJAB HAS NO SPARE WATER TO SHARE WITH OTHER STATES

The Cabinet opined that the state has no spare water to share with any other state so there is no question of construction of Satluj Yamuna Link (SYL) canal. It firmly said that Satluj river has already dried up and there is no question of sharing even a single drop of water from it. Punjab has no surplus water to share with Haryana and reassessment of availability of water is required as per international norms. It was also observed that Punjab’s 76.5% blocks (117 out of 153) are over exploited where the stage of ground water extraction is more than 100%, whereas in Haryana only 61.5% (88 out of 143) are over exploited.

GIVES CONSENT FOR SENDING THE CASES OF PREMATURE RELEASE OF CONVICTS

The Cabinet also gave its consent for sending the case of two prisoners for seeking the premature release of life convicts confined in the jails of the state. After the nod of the Cabinet under Article 163 of the Constitution of India, these special remission/ premature release cases will be submitted to the Punjab Governor under Article 161 of the Indian Constitution for consideration.

GIVES MAJOR RELIEF TO PEOPLE, REMITS 3% ADDITIONAL STAMP DUTY UPTO DECEMBER 31

In a major relief to the people of the state, the Cabinet also remitted 3% additional Stamp Duty (Social Security Fund) levied on Property Registration in Urban Areas (Municipal Corporation and Class-1 Municipalities) upto December 31, 2023. keeping in view the larger public interest, the Cabinet has given its consent to omit Section 3-C and Schedule 1-B, which is chargeable under section 3-C of the Indian Stamp Act 1899. This move will provide concession to property buyers in Urban Areas (Municipal Corporation and Class-1 Municipalities).

APPROVES PROPOSAL FOR INTRODUCTION OF PGST (AMENDMENT) BILL-2023

The Cabinet also gave the approval to the proposal for introduction of the Punjab Goods and Services Tax (Amendment) Bill-2023 to make certain amendments in Punjab Goods and Services Tax Act-2017 in consonance of directions of GST Council. In order to facilitate taxpayers and to promote “Ease of doing Business”, certain visionary amendments in Punjab Goods and Service Tax-2017 are proposed such as Constitution of GST Appellate Tribunal and State Benches thereof, decriminalization of certain offences, facilitation of small traders to supply goods through e-commerce operators, consent based sharing of information and legal provisions for taxation of online gaming and others.

GREEN SIGNAL TO A POLICY TO REGULARIZE EXISTING STANDALONE BUILDINGS

As per the promise made with the industrialists during the recently concluded Sarkaar Sannatkaar Milni the Cabinet also gave green signal to a policy to regularize existing standalone buildings such as Hotels, Multiplexes, Farmhouses, Educational, Medical, Industrial Institutes and others, constructed without permission of Department outside the Municipal Limits, Urban Estates and Industrial Focal points. Under this policy, the opportunity will be given till December 31, 2023 to apply for regularization of standalone buildings, constructed without prior permission. The public may avail the benefit of this policy by submitting requisite documents along with CLU, EDC, SIF, Regularization Fees, Processing Fees and Mining Charges, as per the applicability. The cases received under this policy will be disposed off within six months.